Proyecto

Motivación en datos

Proposal Abstract

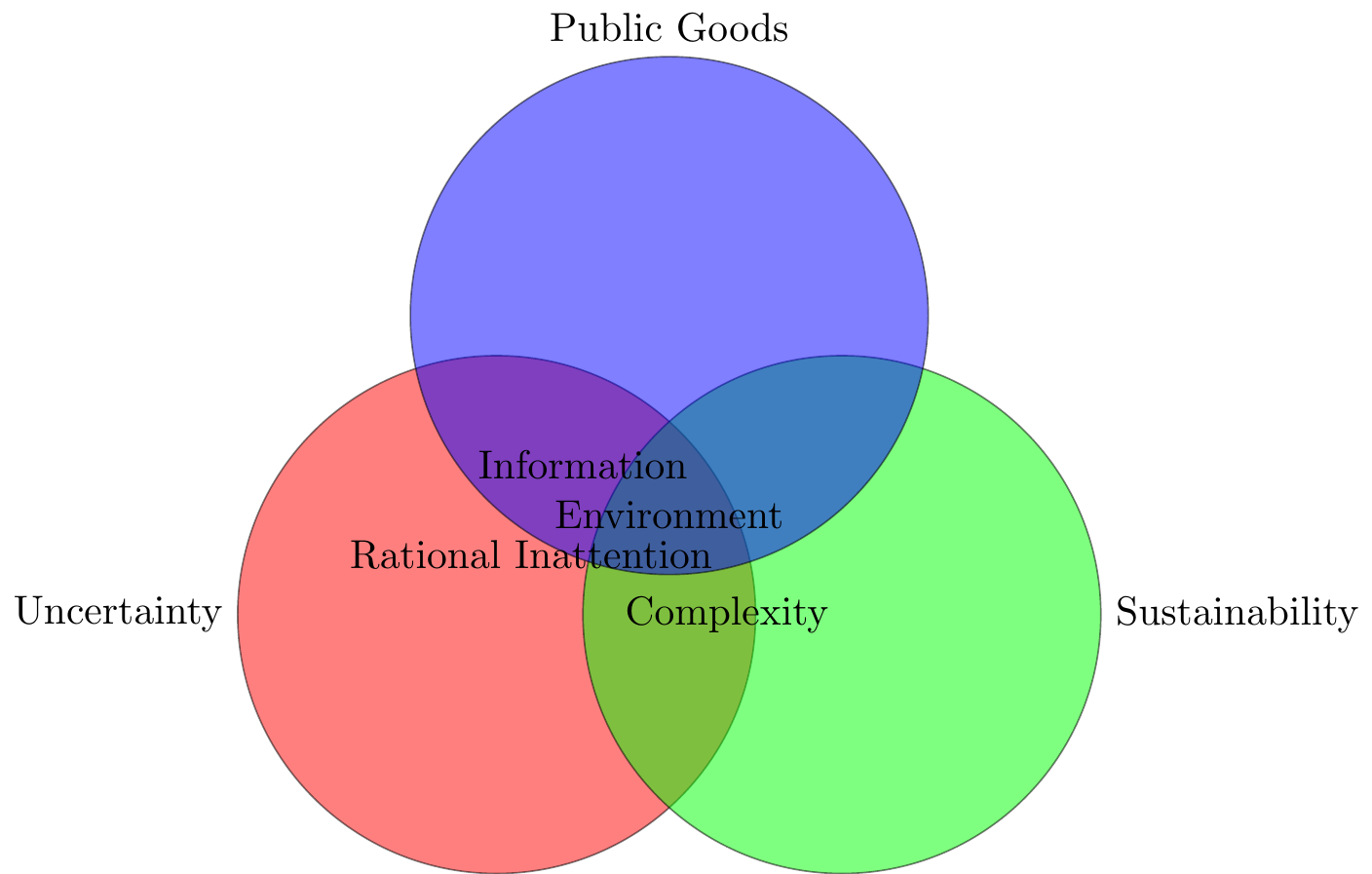

Investment according to environmental, social and governance (ESG) factors, as any other asset typification, has multiple implications over the efficient allocation of resources. Information or agents’ attention to characterize whether an investment satisfies ESG requirements is noisy, costly and/or limited. Furthermore, preferences of decision makers regarding risk or ambiguity play a role when valuing those assets. Should we care on these types of assets? we would discuss some facts providing a motivation for the project. Then, we would like to state the following question: it is possible to achieve efficiency gains understanding the drivers of sustainable finance?

We argue that we should care on assets under management using sustainable investing strategies. For instance, US-domiciled assets using these strategies represent one third of the total investment under professional management US SIF (2020). Moreover, valuation of assets increased 42 percent from 2018 to 2020 according to the same source.1

Efficiency in any problem of resource allocation depends on the existence of a unique form of valuation. Therefore, if identical information induces different valuations across agents, then the allocation of resources could be inefficient. This is typically the case in incomplete markets due to the existence of multiple beliefs that are compatible with no-arbitrage valuation. Another source of inefficiency are externalities. For instance, externalities produced by operations with environmental impact. Thus, more and accurate information should improve efficiency. Nevertheless, the resources to acquire information and decision makers’ capacity to understand information are limited.

This is the case regarding ESG factors. Whether climate or social responsibility are critical (sustainable) characteristics of assets remains a matter of discussion. Consistently, portfolio choice is ruled by the decision maker preferences towards (non) sustainable investment. In turn, preferences depend on information and the capacity to understand the impact of social or environmental uncertainty. Thus, we need to establish a relation between allocation efficiency and preferences or attention capacity.

We want to propose a framework and establish some relations. From a methodological perspective, this project aims to establish 3 novel results (i,ii,iii). In a first stage, both theoretical and applied, we deal with information modeling. The first result (i) elaborates on a conceptual framework based on non-linear pricing. This is a theoretical contribution that generalizes Beissner and Riedel (2019) for multiple commodities and externalities.2 The second result (ii), applies the conceptual framework (i) to provide more structure to the demand and supply in a model of capacity investment and cap-and-trade. In a second and experimental stage, we propose a third result (iii) by pursuing empirical validation of a decision theory model with rational inattention applied to sustainable investment.3

Presentaciones de avance

References

Footnotes

From $12.0 to $17.1 trillion US dollars, where $51.4 trillion is the U.S. professionally managed assets at the year end 2019. Global statistics are available in Alliance (2020)↩︎

Authors state that an “extension to finitely many commodities is straightforward”. This sentence is consistent with complete markets only. For instance, with many commodities, equilibrium existence is never trivial for incomplete markets.↩︎

A particular case of sublinear valuation is a convex form with rational inattention Dewan and Neligh (2020).↩︎